Understanding different types of members can help ensure you’re marketing to their needs.

Not all members are the same. And this diversity goes beyond demographics including age, and even stages of life. What we’re interested in goes deeper – into the current phase members hold at your credit union.

Member needs are drastically different dependent upon the phase they are currently in with your credit union and their levels of loyalty. While it may be true that at some point most members are likely to need an auto loan or credit card, what’s key is how differently you market to those members.

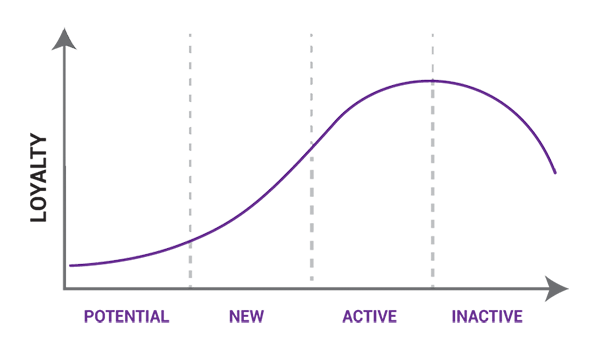

We created our Member Loyalty System (MLS) so credit unions could gain clarity on how to market to different members dependent upon the specific phase and loyalty level they maintain at your credit union, including Potential Members, New Members, Active Members and Inactive Members.

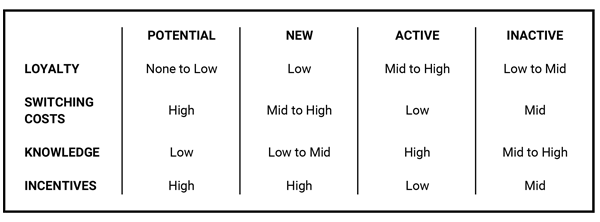

The chart breaks down member phases by a few sample components:

Depending on which phase each member falls in, you’ll notice how varied they are from low to high regarding their loyalty, switching cost considerations, knowledge about your credit union and incentives to enjoy. And, by using this system, it’s easy to market to each group based on the phase they’re in – and much easier than chasing generic demographic segments.

Revealing the Nuances of Potential Members

To illustrate how the MLS works, let’s use Potential Members as an example. These members have practically no loyalty to your credit union. They aren’t current members, have no accounts with you and may have little to no knowledge of your institution and its offerings.

As a result, the time and energy required to switch to your institution are much higher than other member types. Promoting products and services, such as checking accounts, to this group might not be your best choice since those switching costs are high in general. And, let’s be honest, it’s an absolute pain to switch your checking account in the 21st century if you already have auto-payments, transfers, and other time-saving mechanisms in place.

What to do? Look for lower switching cost opportunities, such as an auto loan or credit card. The concept of the “primary financial Institution” is drastically changing in our technology age as people have their finances spread out amongst multiple institutions. Loans are one of the easiest entry points to target potential members due to lower switching costs – if you can provide them with a better deal than they currently have.

Which brings us to incentives. Since Potential Members will require higher incentives to offset higher switching costs, your best incentives should be crafted for this type of member and for New Members. While you may argue that Active Members should receive your best incentives because of their loyalty, these members already take advantage of a greater total sum of perks and benefits daily. They receive these through all their current services, including lower fees, higher investment yields, overall lower loan rates and many services are even provided at no cost.

A Targeted Approach to Member Marketing

Segmenting members based on demographics is vital if your products and services are age specific, such as a clothing store. However, most financial products and services are applicable to every age group in some way; requiring a different approach to how we look at and target specific members.

By incorporating an approach that considers member phase and loyalty level, you can easily define their needs and challenges – and better understand how to market specifically toward each of these groups. Then, you can expand your marketing reach even further by implementing psychographics – creating powerful segments void of basics such as age.

Our Member Loyalty System (MLS) provides insight into which products and services you should promote, how to promote them and more – during each phase to deepen member relationships. Interested? Let’s Chat.